Introduction: Your Financial Roadmap to Success

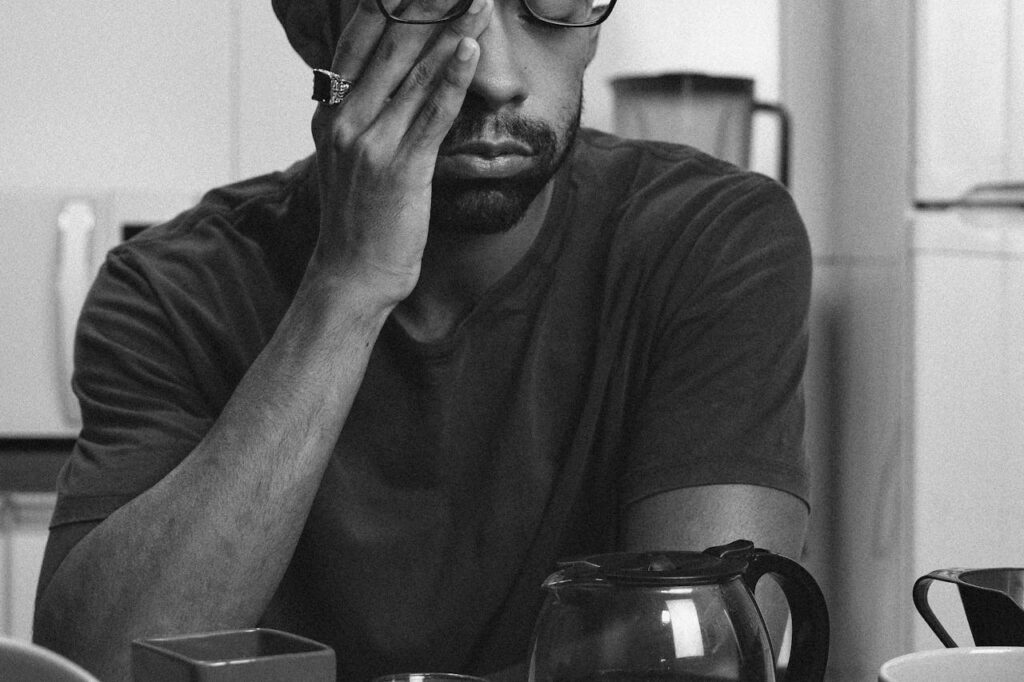

You’re sitting at your kitchen table, staring at a stack of bills, wondering how to turn your hard-earned money into lasting wealth. Sound familiar? Don’t worry—you’re not alone.

Wealth planning isn’t just for millionaires or financial gurus. It’s for anyone who wants to take control of their financial destiny and build a secure future.

What exactly is wealth planning, and why should you care? Let’s break it down and show you how this powerful strategy can transform your financial life.

What is wealth planning? More Than Just Counting Pennies

Wealth planning is like having a GPS for your financial journey. It’s a comprehensive approach to managing your money that goes far beyond simply saving a few dollars here and there. We’re talking about:

- Investment Management: Strategically growing your money

- Tax Strategies: Keeping more of what you earn

- Retirement Planning: Ensuring a comfortable future

- Estate Management: Protecting and passing on your assets

Think of wealth planning as your financial superhero—fighting off unexpected expenses, tax burdens, and retirement uncertainty.

Why Wealth Planning Matters (Spoiler: It’s Not Just for the Rich)

Myth Busting: Wealth Planning is for Everyone

Here’s a truth bomb: Wealth planning isn’t reserved for people with million-dollar bank accounts. Whether you’re making $30,000 or $300,000 a year, a solid wealth plan can help you:

- Minimize Tax Burdens: Keep more money in your pocket

- Protect Your Assets: Shield yourself from financial uncertainties

- Achieve Long-Term Goals: Turn your dreams into reality

- Prepare for the Unexpected: Build a financial safety net

The Real-World Impact: A Personal Story

I remember my friend Sarah, who thought wealth planning was only for “rich people.” She was living paycheck to paycheck, stressed about her finances. After working with a financial advisor and creating a comprehensive wealth plan, she:

- Reduced her tax liability

- Started an investment portfolio

- Built an emergency fund

- Felt confident about her financial future

Key Components of a Killer Wealth Plan

1. Investment Management: Your Money’s Workout Routine

Just like you’d train your body, your money needs a serious workout. This means:

- Diversifying your investment portfolio

- Balancing risk and potential returns

- Regularly reviewing and adjusting your strategy

2. Tax Strategies: Keep More of Your Hard-Earned Cash

Nobody likes paying more taxes than necessary. Smart wealth planning helps you:

- Identify tax-efficient investment strategies

- Maximize deductions

- Plan for long-term tax optimization

3. Retirement Planning: Your Future Self Will Thank You

Retirement isn’t just about stopping work; it’s about maintaining your lifestyle and enjoying your golden years. A solid plan considers:

- Projected expenses: estimated costs or expenditures expected to occur in the future, often used in financial planning.

- Income sources: The various means through which an individual or organization earns money, such as salaries, investments, or business revenue.

- Healthcare costs: expenses related to medical care, including insurance, treatments, medications, and doctor visits.

- Potential lifestyle changes: adjustments to one’s way of living, which may include changes in spending, activities, or priorities due to personal or external factors.

4. Risk Management: Your Financial Safety Net

Life is unpredictable. A comprehensive wealth plan includes:

- Emergency funds: Savings set aside to cover unexpected expenses or financial emergencies, such as medical bills or job loss.

- Insurance strategies: plans or approaches to selecting and managing insurance policies to provide financial protection against risks.

- Asset protection techniques: methods used to safeguard personal or business assets from potential risks, such as lawsuits, creditors, or economic downturns.

Common Wealth Planning Mistakes to Avoid

The Pitfalls That Can Derail Your Financial Goals

- Neglecting Diversification: Putting all your eggs in one basket

- Ignoring Tax Implications: Overlooking potential tax-saving strategies

- Failing to Update Your Plan: Not adjusting to life changes

- Underestimating Future Expenses: Wishful thinking about retirement costs

How to Get Started: Your Wealth Planning Roadmap

Step 1: Assessment

- Take a hard look at your current financial situation

- List your assets, debts, and financial goals

Step 2: Consult a Professional

- Find a qualified financial advisor

- Create a personalized wealth plan

Step 3: Implement and Review

- Put your plan into action

- Review annually or after major life changes

Top Tools to Supercharge Your Wealth Planning

Want to take your wealth planning to the next level? Check out these game-changing tools:

- Personal Capital: Free financial dashboard

- Mint: Budgeting and expense tracking

- Wealth front: Automated investment planning

- Betterment: Personalized robo-advisor

- H&R Block Tax Software: Maximize deductions and minimize tax liability

Your Financial Future Starts Now

Wealth planning isn’t a one-time event – it’s an ongoing journey. The best time to start? Right now. Whether you’re 25 or 55, there’s no better moment to take control of your financial destiny.

Your Next Steps

- Assess Your Current Financial Situation

- Research Financial Advisors

- Start Small, Dream Big

Remember, wealth planning is about progress, not perfection. Every step you take is a step towards financial freedom.

Disclaimer: This guide is for informational purposes only. Always consult with a qualified financial professional before making significant financial decisions.