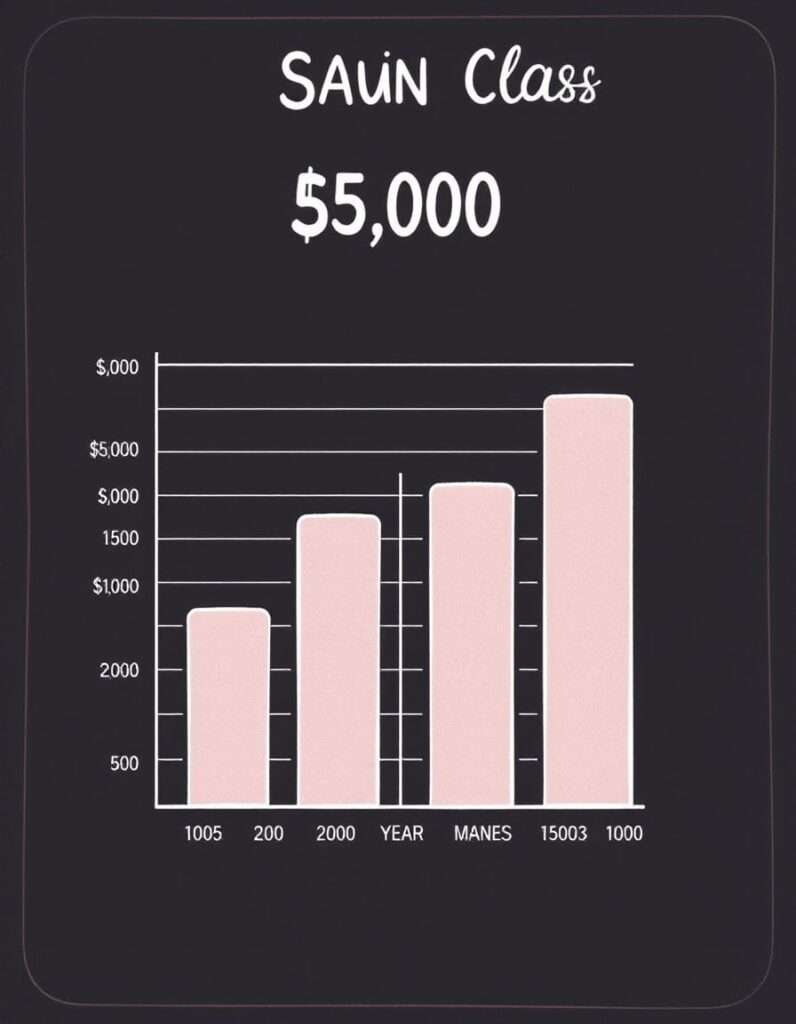

Saving money can feel like climbing a mountain—daunting, overwhelming, and sometimes impossible. But what if I told you that saving $5,000 in a year is not only achievable but also simpler than you think? Whether you’re saving for a dream vacation, an emergency fund, or just want to build better financial habits, this guide will walk you through simple, actionable steps to help you reach your goal. Let’s break it down together!

Why do you want to save $5000 in a year?

Before we dive into the how, let’s talk about why you Saving $5,000 in a year is a realistic and meaningful goal for you. It is enough to cover emergencies, fund a big purchase, or even jumpstart your retirement savings. Plus, achieving this goal can boost your confidence and set you up for long-term financial success. Ready to get started? Let’s go!

How to Save $5000 in a Year: Let’s Breakdown into small steps

To save $5000 in a year, you will need to save approximately $417 per month, $96 per week, and $14 per day. This sounds manageable, right? Here are the steps you can take to make your dream come true this year:

1. Create a Budget That Works for You

The foundation of saving money is budgeting. Without a plan, your money tends to slip through the cracks. Here is how to create a budget that sticks:

- Track Your Spending: Use apps like Mint or YNAB (You Need A Budget) to see where your money is going. You might be surprised by how much you spend on small, unnecessary purchases.

- Set Spending Limits: Allocate specific amounts for essentials (rent, utilities, groceries) and discretionary spending (entertainment, dining out).

- Stick to the 50/30/20 Rule: Spend 50% on needs, 30% on wants, and save 20% of your income.

2. Cut Back on Discretionary Spending

Let’s be real—most of us spend money on things we don’t really need. Here are some easy ways to cut back:

- Dining Out: Cook at home more often. Meal prepping can save you hundreds of dollars each month.

- Subscription Services: Cancel unused subscriptions (looking at you, gym membership you never use).

- Impulse Buys: Implement a 24-hour rule—wait a day before making non-essential purchases.

3. Automate Your Savings

Out of sight, out of mind! Set up an automatic transfer to your savings account every payday. Even $50 per paycheck adds up over time. Consider opening a high-interest savings account to earn more on your money while it sits.

4. Increase Your Income

Sometimes, cutting expenses isn’t enough. Here’s how to bring in extra cash:

- Side Hustles: Drive for Uber, sell handmade crafts on Etsy, or freelance in your area of expertise.

- Sell Unused Items: Declutter your home and sell items on platforms like eBay or Facebook Marketplace.

- Ask for a Raise: If you’ve been excelling at work, it might be time to negotiate a higher salary.

5. Take on a Savings Challenge

Make saving fun with these creative challenges:

- No-Spend Month: Pick a month to cut out all non-essential spending.

- Daily Savings Challenge: Save 1 on Day 1, 1 on Day 1, 2 on Day 2, and so on. By Day 30, you’ll have saved $465!

- 52-Week Challenge: Save 1 in Week 1, 1 in Week 1, 2 in Week 2, and so on. By the end of the year, you’ll have saved $1,378.

6. Save Money on Groceries

Groceries are a major expense, but there are ways to save:

- Plan Your Meals: Create a weekly meal plan and stick to your shopping list.

- Use Coupons and Cashback Apps: Apps like Ibotta and Rakuten can help you save on everyday purchases.

- Buy in Bulk: Stock up on non-perishable items when they’re on sale.

7. Track Your Progress

Keeping track of your savings is key to staying motivated. Use a printable savings chart or a budgeting app to visualize your progress. Celebrate small milestones along the way—like hitting 1,000 or 2,500—to keep yourself motivated.

Your Turn: Take the First Step

Now that you have the tools and strategies to save $5,000 in a year, it’s time to take action. Here’s a quick recap of what you can do right now:

- Set Up a Budget: Use an app or a simple spreadsheet to track your income and expenses.

- Automate Your Savings: Set up a recurring transfer to your savings account.

- Cut one expense: Identify one non-essential expense you can eliminate or reduce.

- Explore Side Hustles: Brainstorm ways to earn extra income, even if it’s just a few dollars a week.

- Celebrate Small Wins: Reward yourself when you hit milestones—it’ll keep you motivated!

Frequently Asked Questions (FAQs)

1. How can I realistically save $5,000 in a year?

By breaking it down into smaller, manageable goals—like saving 417 per month or 14 per day—you can make steady progress. Combine budgeting, cutting expenses, and increasing your income to reach your goal.

2. What are some effective budgeting strategies for saving money?

The 50/30/20 rule, zero-based budgeting, and using budgeting apps like Mint or YNAB are all effective strategies. Find one that works for your lifestyle.

3. How much should I save each month to reach $5,000 in a year?

You’ll need to save about $417 per month. If that feels like too much, start smaller and gradually increase your savings as you cut expenses or earn more.

4. What expenses can I cut back on to save more money?

Focus on discretionary spending like dining out, subscription services, and impulse buys. Small changes in these areas can add up quickly.

5. Are there specific tools or apps that can help me track my savings?

Yes! Apps like Mint, YNAB, and Personal Capital are great for tracking your savings and expenses. Many banks also offer built-in budgeting tools.

Small Changes, Big Results

Saving $5,000 in a year isn’t about making drastic sacrifices or overhauling your entire life. It’s about making small, intentional changes that add up over time. Whether it’s skipping that daily latte, negotiating a better deal on your cable bill, or picking up a side hustle, every step you take brings you closer to your goal.

Remember, financial success is a journey, not a sprint. Be patient with yourself, stay consistent, and don’t be afraid to adjust your plan as needed. The most important thing is to start today. Even if you can only save $10 this week, that’s $10 this week; after 52 weeks you have $520; remember every bit counts towards your larger goal.

You: What’s your biggest challenge when it comes to saving money? Share your thoughts in the comments below, and let’s support each other on this journey. If you found this guide helpful, don’t forget to share it with a friend who could use a little financial inspiration. Together, we can make saving $5,000 in a year not just a goal but a reality.